1 Introduction

Identifying and assessing the risks faced by supervised entities is crucial for successfully conducting banking supervision and serves as a basis for the supervisory priorities that are set during the regular strategic planning process.

ECB Banking Supervision conducts an annual risk identification and assessment exercise in close cooperation with the national competent authorities (NCAs). The analysis draws on a wide range of contributions, including from the Joint Supervisory Teams and the ECB’s horizontal microprudential and macroprudential functions. It is also informed by discussions with banks and other relevant authorities.

2 SSM Risk Map for 2020

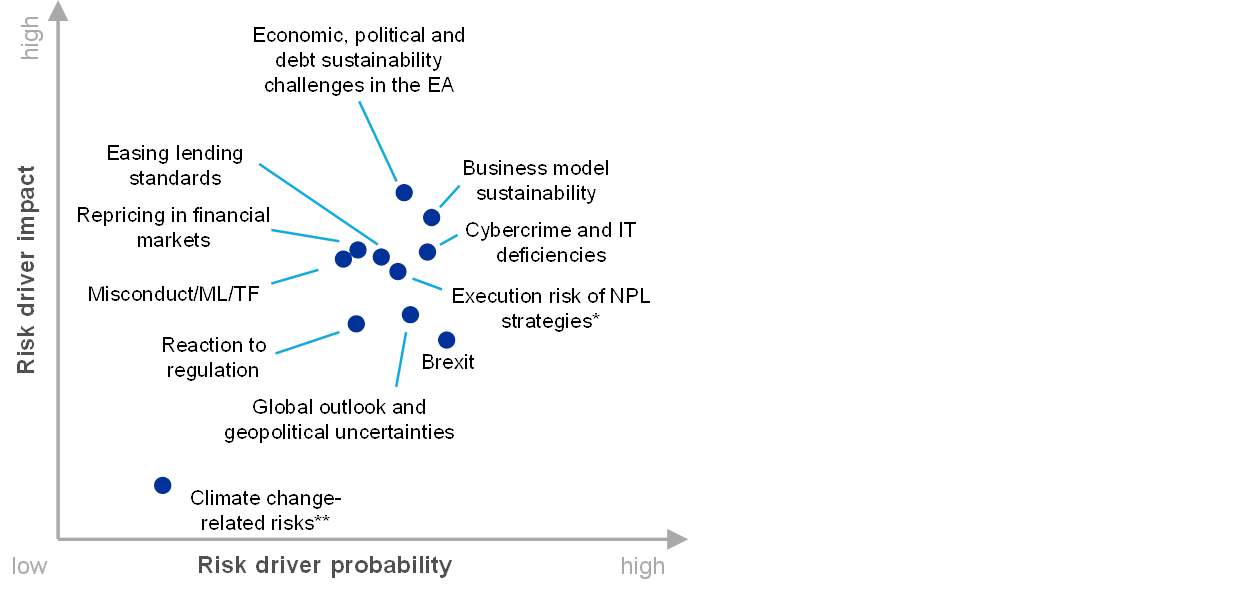

The Single Supervisory Mechanism (SSM) Risk Map shows the key risk drivers affecting the euro area banking system over a two to three-year horizon (see Figure 1) along the dimensions of probability and impact. The risk drivers should not be seen in isolation as they may trigger or reinforce each other. The Risk Map highlights only the key risk drivers and does not provide an exhaustive list of all risks faced by supervised banks.

Figure 1

SSM Risk Map for 2020

Source: ECB and NCAs.

Notes: *The execution risk attached to banks’ strategies for non-performing loans (NPLs) only applies to banks with high levels of NPLs.

**Climate change-related risks are more relevant over the longer-term horizon (i.e. a horizon of more than three years).

The three most prominent risk drivers expected to affect the euro area banking system over the next three years are: (i) economic, political and debt sustainability challenges in the euro area, (ii) business model sustainability and (iii) cybercrime and IT deficiencies. These are followed by: execution risk attached to banks strategies’ for non-performing loans (NPLs); easing lending standards; repricing in financial markets; misconduct, money laundering and terrorist financing (ML/TF); Brexit; the global outlook and geopolitical uncertainties; reaction to regulation; and climate change-related risks. Compared with last year, risks related to euro area economic conditions have increased. The economic cycle is maturing and the global outlook has deteriorated, partly on account of prolonged uncertainties such as the rising threat of protectionism. This, together with the prolonged period of low interest rates that is expected to continue, adds to concerns about the subdued profitability of euro area banks and the sustainability of their business models. More intense scrutiny of money laundering cases also increases the risk of losses owing to misconduct.

3 Key risk drivers

Economic, political and debt sustainability challenges in the euro area have grown over the past year, increasing risks to the euro area banking sector, including credit risk and profitability prospects. The euro area economic growth projections for 2019‑20 have been revised down compared with a year earlier but still point towards economic expansion. Nevertheless, pronounced downside risks to growth remain, mainly on account of persistent weaknesses in global trade and higher geopolitical uncertainty. Weak progress on reform weighs on potential output as many euro area countries remain less ambitious in their efforts to address structural rigidities and stock imbalances. Despite economic expansion in recent years, debt sustainability concerns remain pronounced, exposing euro area countries with high debt levels to sudden changes in financial market perceptions. Significant domestic sovereign exposures of banks in those jurisdictions leave room for the potential re-emergence of disruptive sovereign-bank loops. Moreover, household debt and, in particular, corporate debt in the euro area continue to stand on average at high levels, making these sectors vulnerable to potential shocks. The rise of inward-looking policies in some EU countries continues to present political challenges for the euro area. The increased political fragmentation resulting from these policies might increase uncertainty and strengthen the economic and fiscal challenges facing euro area countries.

Business model sustainability remains an area of focus as significant institutions (SIs) in the euro area continue to struggle with low profitability. The outlook of prolonged low interest rates and intense competition weigh further on banks’ ability to generate income. At the same time, expenses have remained stable on aggregate, as cost-saving efforts have been partly offset by factors such as rising salaries, the need for IT investments and improvements in risk management. Over half of banks currently generate a return on Equity (RoE) which is below their estimated cost of equity. As a result, the market valuation of most listed euro area SIs remains low and price-to-book ratios have, on average, remained below one since the financial crisis. Following a slight improvement in RoE in 2018, banks’ own projections point to a dip in their RoE in 2019 and 2020 and then a sluggish recovery in 2021. However, there are significant downside risks associated with such a scenario: the macro-financial environment has worsened in the period since these projections were prepared, and banks may have not fully incorporated the effects of competition into their estimates, in particular in those segments where many banks expect to grow. Moreover, while digitalisation can improve cost-efficiency in the medium term and enable banks to offer new products and services, it challenges banks to rethink their business models and strategies. It also requires banks to make short-term investments in order to adjust the way they operate and interact with clients. In the medium term, it also raises the prospect of further non-bank competition, potentially including big tech firms. Banks need to continue to adjust their business models to bring them onto a sustainable footing, and the risks of falling short of sustainable profitability remain significant.

Continued digitalisation of financial services makes banks more vulnerable to cybercrime and operational IT deficiencies. The overall interconnectedness of banks with parties inside and outside the financial sector is deepening. Large parts of banks’ IT systems are provided by third or even fourth parties. The potential individual and systemic concentration of a few service providers requires adequate risk and dependency management. Banks are becoming increasingly aware of existing deficiencies in their IT risk controls.[1] At the same time, cybercriminals with a strong collective malicious intent bring additional risks. Cyber incidents can result in significant costs or reputational losses for banks and can even have systemic consequences, as threats can spread quickly through sectors. A high number of SIs rely on end-of-life IT systems for critical business processes, which increases their vulnerability to cyber risk.

Despite a significant improvement in asset quality in recent years, high levels of NPLs remain a concern for a large number of euro area banks. Over the past year, high NPL banks have made good progress in the execution of the NPL strategies which they were required to agree as part of the ECB’s guidance on NPLs. On aggregate, compared to last year, SIs’ stock of NPLs fell by €112 billion to €587 billion in the first quarter of 2019 and the average NPL ratio dropped from 4.7% to 3.7%. Despite this progress, the average NPL ratio in the euro area is still above pre-crisis levels and significantly higher than in other major industrialised economies. A number of banks also have high levels of aged NPLs that might be more difficult to work out. Moreover, inflows of new NPLs still appear to be on the high side. Although the most recent NPL strategies have generally been very ambitious, the maturing economic cycle in the euro area might limit the banks’ progress in implementing these strategies. Banks are encouraged to continue their efforts to clean up their balance sheets and increase their resilience to potential future shocks.

The recent period of easing lending standards,[2] which followed a severe tightening during the crisis, might result in a build-up of NPLs in the future. Only recently lending standards for loans to households for house purchase, consumer credit and loans to enterprises have tightened somewhat, although pockets of rapid credit growth remain.[3] In particular, more relaxed lending standards for residential real estate loans may increase credit risk for banks given the high share of this type of loan in their portfolios. In some countries, high loan-to-value and debt service-to-income ratios combined with high borrower indebtedness might make it more difficult for borrowers to repay if economic conditions were to deteriorate. This could also lead to significant losses for banks in the event that borrowers default. Moreover, driven by the ongoing search for yield, investors seem to be turning to riskier sectors. The leveraged loan market remained buoyant throughout 2018, though new issuance did not reach the peak recorded in 2017. However, new transactions show a further decrease in investors’ protection, potentially leading to higher losses in the event of an economic downturn.

The risk of an abrupt and significant repricing in financial markets remains significant. Following the sell-off in December 2018, global stock prices rebounded in the first half of 2019. Despite the correction, asset valuations remain high in certain market segments.[4] Volatility in financial markets decreased somewhat in the first half of 2019 before increasing in August, fuelled mostly by renewed trade tensions. At the same time, risk premia remain compressed. A materialisation of the downside risks to the economic outlook or further intensification of geopolitical tensions could lead to a repricing of risk premia. This would have an adverse effect on banks’ balance sheets, capital positions and funding costs. A potential repricing could also have a negative impact on euro area economic or fiscal conditions, affecting banks in turn. Moreover, in an extreme case, a major repricing could threaten the solvency of central counterparties if it coincided with other major events, potentially posing a systemic risk.

Concerns related to money laundering and terrorist financing (ML/TF) have increased since last year. The recent breaches or alleged breaches of anti-money laundering rules in the banking sector have led to greater scrutiny by law enforcement agencies, regulators and the media, which may result in an increase in the number of breaches detected in the future. Involvement in cases of money laundering poses significant risks to banks and their viability, and it is often connected to weak governance and poor risk controls. While the competency to supervise ML/TF matters remains with national authorities, the ECB must consider the potential risks involved when carrying out its supervisory activities, including the Supervisory Review and Evaluation Process, assessments of the adequacy of institutions’ governance arrangements and assessments of the suitability of members of management bodies.[5] Overall, banks need to pay greater attention to their internal processes and, in some cases, make improvements to their governance frameworks. Supervisors continue to closely monitor a number of governance-related issues, including the composition and functioning of boards of directors, internal control functions and processes, data quality and reporting.

Uncertainty around the United Kingdom’s membership of the EU remains high and the risk of a no-deal Brexit remains. Although the adverse impact of such a scenario is expected to be modest for the EU, on average, there are nevertheless tail risks concentrated in particular countries and banks with close links to the United Kingdom. A no-deal Brexit could cause significant market turbulence, potentially resulting in tighter financing conditions. Combined with the negative effect via trade and confidence channels, this poses a substantial downside risk to euro area GDP growth in the short term. Cliff-edge risks related to the continuity of cleared and uncleared derivative contracts have been addressed either through the temporary equivalence decision taken by the European Commission or other mitigating measures. At the same time, however, some banks are behind schedule in implementing their contingency plans and need to step up their preparations, including transferring staff and strengthening local risk management capabilities and governance structures.

The global economic outlook for 2019 has deteriorated following the significant deceleration in global economic expansion in the second half of 2018. Global growth is expected to stabilise in the next two years, albeit at relatively low levels. Significant downside risks remain, primarily related to weak global trade and manufacturing activity, volatile global financial conditions, and high and rising geopolitical uncertainties, including the rise of protectionist policies. In particular, a further escalation of trade disputes between the United States and China might also weigh on business confidence, threaten global supply chains and reduce global growth.

The main post-crisis financial regulatory initiatives have recently been finalised but some, such as Basel III completion, are still to be incorporated into EU or national law. Uncertainty stemming from potential new regulation has therefore decreased, but banks still need to adapt to operate in this new regulatory environment. The full implementation of the Basel framework as part of the CRR III/CRD VI package will lead to an increase in minimum capital requirements and, as a result, an aggregated capital shortfall across EU banks. This impact on capital is mainly driven by large, globally active banks. Together with the minimum requirement for own funds and eligible liabilities (MREL), total loss-absorbing capacity (TLAC) and other regulatory initiatives that have been implemented, such as the International Financial Reporting Standard 9 (IFRS 9), the revised Markets in Financial Instruments Directive (MiFID II) and the revised Payments Services Directive (PSD2), this recent regulation will influence banks’ strategic decisions and investment behaviour.

Central banks and supervisory authorities are increasingly focusing on climate change-related risks, and are collaborating with other international bodies in the Network for Greening the Financial System, of which the ECB is a member. It is likely that climate change-related risks will have both a direct and indirect impact on banks. More severe weather phenomena and the transition to a low-carbon economy could have significant adverse implications for euro area banks, including for the continuity of their operations and the risk profile of their assets (such as exposures to the automotive sector). Climate change-related risks are expected to intensify in the longer term (i.e. over a horizon of more than two to three years). Banks should therefore adequately integrate these risks into their risk management framework.

© European Central Bank, 2019

Postal address 60640 Frankfurt am Main, Germany

Telephone +49 69 1344 0

Website www.bankingsupervision.europa.eu

All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged.

For specific terminology please refer to the SSM glossary (available in English only).

PDF ISBN 978-92-899-3924-9, ISSN 2599-9850, doi:10.2866/81566 QB-CK-19-001-EN-N

HTML ISBN 978-92-899-3927-0, ISSN 2599-9850, doi:10.2866/728 QB-CK-19-001-EN-Q

- This was observed in the ECB’s analysis of the IT risk self-assessment questionnaires submitted by banks in 2018.

- See the euro area bank lending survey.

- More detailed analysis will be made available following the completion of ECB Banking Supervision’s data collection on lending standards.

- These include commercial real estate markets.

- Recital 20 of Directive (EU) 2019/878 of the European Parliament and of the Council of 20 May 2019 amending Directive 2013/36/EU as regards exempted entities, financial holding companies, mixed financial holding companies, remuneration, supervisory measures and powers and capital conservation measures (OJ L 150, 7.6.2019, p. 253).